UPDATE: This post has been edited to reflect 2018 updates to CFRA eligibility requirements, as well as increased benefit amounts for SDI and PFL.

Maternity leave in the United States already sucks as it is, but what do you do if you don’t qualify FMLA or CFRA? Currently, to be eligible for FMLA or CFRA you need work for an employer with over 50+ or 20+ employees, respectively. Further, both laws are only applicable to those who have been at their current employer for at least one year, and have clocked in at least 1,250 hours of work within the past year. So, what happens to employees who work at small companies or are new(ish) to their jobs? They don’t qualify. Lame!

But, have no fear, even without FMLA and CFRA, you will be entitled to some level of job-protected and paid maternity leave.

First off, in the context of maternity leave in California – don’t worry about FMLA. FMLA is – more or less – irrelevant in California since Pregnancy Disability Leave (PDL) supersedes FMLA. So, even if you don’t meet the FMLA eligibility requirements, you are eligible for PDL as long as you are a California employee who works for an employer with 5+ employees. There is no additional eligibility requirement for PDL, such as minimum hours worked or length of service. Thanks California for looking out for pregnant mommas!

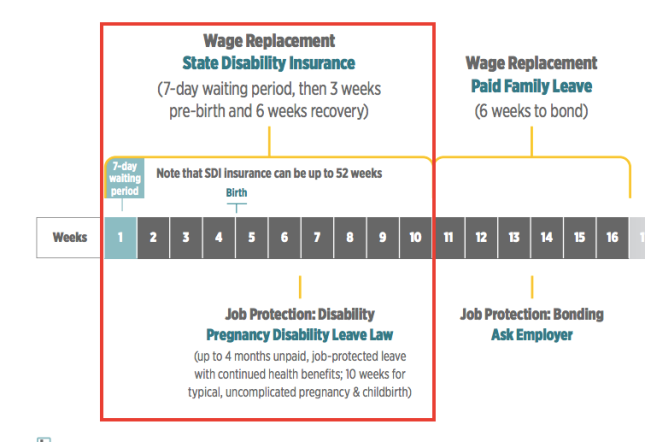

To cut to the chase, here’s what a PDL-only eligible timeline for a typical, uncomplicated pregnancy and vaginal childbirth looks like.

The “Disability” portion of your leave

The “Disability” portion of your leave

Let’s start by talking about the disability portion of your leave as highlighted below…

PDL starts the first day of your disability (aka when your maternity leave starts), and provides up to 17.3 weeks of unpaid job protected leave for the purpose of pregnancy, childbirth, and other related conditions. You don’t automatically get all 17.3 weeks of leave. The actual duration of your PDL must be certified by your doctor, but the “default” duration of PDL for a healthy, uncomplicated pregnancy/childbirth is 4 weeks before birth and 6 weeks after for a vaginal delivery or 8 weeks after for a c-section. Should you have any complications during pregnancy (i.e. high-risk issues, preeclampsia, bed rest, etc) or post birth (physical issues, postpartum depression, etc), your doctor can certify an extension(s) beyond the “default” duration.

While PDL provides unpaid job protection for the duration you are “disabled” by pregnancy and childbirth, you may be eligible to receive wage replacement of either 60% or 70% of your normal weekly wage through State Disability Insurance (SDI). To be eligible for SDI benefits, you must have earned at least $300 from which SDI deductions were withheld during a previous “base period.” Read this post for more information on the base period and how SDI is calculated.

The “Bonding” portion of your leave

Now, we come to the unfortunate, tricky part of being only PDL-eligible….the “bonding” portion as highlighted below.

As comparison, here’s what a PDL/FMLA + CFRA eligible timeline for a typical, uncomplicated pregnancy and vaginal childbirth looks like.

As comparison, here’s what a PDL/FMLA + CFRA eligible timeline for a typical, uncomplicated pregnancy and vaginal childbirth looks like.

Typically, when a mother is eligible for CFRA, following PDL/SDI she is entitled to an additional 12 weeks of unpaid job-protected leave for the purpose “bonding” with the baby. During these 12 weeks of CFRA, you can get 6 weeks of partial pay though Paid Family Leave (PFL) and the remaining 6 weeks are unpaid. However, if you don’t meet all the CFRA requirements below, you are not entitled to job-protected time off for bonding following PDL.

CFRA eligibility requirements:

- Work for an employer with over 20+ employees within a 75 mile radius

- Have worked at employer for at least one year

- Have worked at least 1,250 hours in the last year

By now, it’s clear that you aren’t eligible for job protection under CFRA, but can you still access PFL? After all, PFL is something you’ve been paying into through CA SDI tax deductions. So, here’s the actual tricky part….By virtue of having paid into SDI taxes, you are technically eligible to claim PFL following PDL/SDI. However – the kicker is – since PFL is only wage replacement and does not provide job protection, you would need to be CFRA-eligible to have your job protected while taking leave to collect PFL. Crap!

[UPDATE: The maximum duration of PFL benefits will increase from 6 weeks to 8 weeks, beginning on July 1, 2020. This does not change the fact that PFL is NOT a job-protected leave of absence. You must still be eligible for CFRA in order for your job to be protected while taking time off to collect PFL benefits.]

But, even when law mandated job-protected leave is not available to you, you may be able to still request leave independent from CFRA from your employer. So, it’s definitely worth the conversation with your employer to see if they have any Leave of Absence (LOA) policies outside of CFRA. The other bummer is that without law-mandated CFRA, your request to take leave would be subject to employer approval. If you do happen to get approval to take non-CFRA leave, PFL is paid out at the same rate as your SDI benefit.

I know it’s not much maternity leave compared to say Croatia, which gives moms an entire year of full pay. But, at least you’re getting some time to prepare and be with your little one….even if you’re sleep deprived.

If you have questions regarding California maternity leave, or would like more information on how I can provide individualized support to help maximize your maternity leave, please visit Maternity Leave 411.

If you are PDL/FMLA + CFRA eligible, read this post on how to Milk Your Benefits!

Are you sure PDL only gives you 6 weeks after vaginal birth? I’ve seen online it gives you a maximum of four months. Thanks!

LikeLike

Hi Michelle, you’re absolutely correct that PDL provides up to 4 months of leave. I should have been clear in noting that for typical, healthy pregnancies, doctors will typically approve leave for 4 weeks before and 6-8 weeks after birth. Thanks!

LikeLike

So you can apply for SDI and then PFL to get a total of 12 weeks paid a the %? Or is it just one or the other and a max of 6 weeks paid %?

LikeLike

SDI and PFL are two separate programs and funds.

As long as you’re eligible to receive SDI and PFL….you can receive SDI during your period of disability (ex: for 6 weeks after birth) AND claim an additional 6 weeks of PFL for baby bonding.

LikeLike

A part time 6 hour a day 9.4 month employee who is not qualified for CFRA could get 12 weeks unpaid leave for bonding time if they have worked at least one year with a company?

LikeLike

In order to be eligible for bonding leave under CFRA or NPLA, you must meet ALL the following requirements:

1) Work for an employer with over 50+ employees within a 75 mile radius (CFRA) or 20+ employees within a 75 mile radius (NPLA)

2) Have worked at employer for at least one year (both CFRA and NPLA)

3) Have worked at least 1,250 hours in the last year (both CFRA and NPLA)

You’ll get to 1,250 hours if you work approx 25hrs/week.

Hope that helps!

LikeLike

How long is bonding time in CA?

Is it 6 or 12 weeks?

With pay or unpaid?

LikeLike

Bonding leave under CFRA is 12 weeks. Of those 12 weeks of unpaid leave, you can receive wage replacement through Paid Family Leave (PFL) for 6 weeks. The remaining 6 weeks are unpaid CFRA unless you use PTO or vacation time.

LikeLike

Is a person only eligible for PFL if they are eligible for CFRA/FMLA?

LikeLike

No, you can be eligible for PFL regardless of CFRA/FMLA eligibility.

However, PFL is only wage replacement, and does not provide job protection. As such, you’d either need to be:

1) CFRA/FMLA eligible to get job protection while on leave collecting PFL; OR

2) Request a leave of absence (independent from CFRA/FMLA) from your employer in order to get the time off to collect PFL. In this situation, since your leave of absence request is not a law-mandated protected leave, your employer does not have to approve your request, and approval is subject to your employer’s policy and terms.

Hope that helps.

LikeLike

When you say, “The other bummer is that without law-mandated CFRA, your request to take leave would be subject to employer approval. If you do happen to get approval to take non-CFRA leave, PFL is paid out at the same rate as your SDI benefit.” Does my employer need to fill out any special paperwork/show that they approved me LOA for me to be eligible for PFL, or when you say it is subject to employer approval are you referring to the job protection aspect?

LikeLike

Thanks for asking that question. The way I’ve phrased it is confusing.

To answer your question – Just the job protection aspect. Your employer doesn’t need to provide anything to the EDD (the dept who oversees PFL).

LikeLike

Do I need to apply for PFL separately from SDI? Or they just run together?

LikeLike

You will need to apply for PFL separately from SDI. You won’t automatically get enrolled into PFL – there are actionable steps for you to take. If you apply for SDI online, you’ll be able to apply for PFL after you’ve finished collecting SDI. Of note, you can’t claim PFL until you are DONE with SDI.

LikeLike

Thank you for answering my last question. So if I do qualify for CFRA and my return date should be December 14. But my employer is persistent that I exhausted all of my leave of absences.

And that the company will to move to separate my employment.

Is there anything I can do ?

LikeLike