As of January 1, 2018, benefit rates for both SDI and PFL have increased from 55% to either 60% or 70%, depending on income. I’ll get into the nitty-gritty in just a bit, but for now, to get an idea of what your SDI and PFL benefits might be, check out this handy-dandy calculator. This calculator really should only be used to get an approximate figure since there are a number of factors (i.e. health insurance premiums deducted pre-tax) that can adjust your gross wage.

If you want to learn exactly how your benefit amount is calculated, read on. Otherwise, you can just rely on the calculator for an estimate, but you know what they say….”knowledge is power!”

First and foremost, to be eligible for SDI and PFL, you must have been or currently paying into CA SDI taxes through your payroll deductions. If you aren’t sure, take a look at your pay stubs and you’ll find deductions for something along the lines of CASDI, SDI, or DI. If you’ve got that, you’re golden. Moving on….

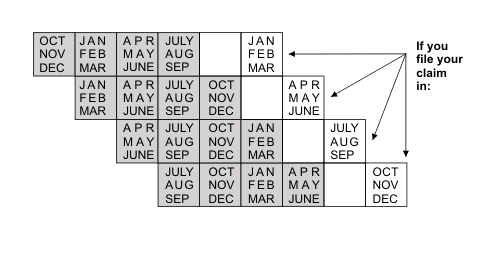

Your SDI/PFL benefit amount is based on the quarter with the highest gross wages earned within a particular base period. Your base period varies depending on what month you file for disability (see chart below).

A base period covers 12 months and is divided into four consecutive quarters. The base period includes gross wages subject to SDI tax which were paid approximately 5 to 18 months before your disability claim began. Of note, the base period does not include wages paid at the time your disability begins. For a SDI claim to be valid, you must have at least $300 in wages in the base period.

To determine if you are eligible for benefits at 60% or 70%, your highest earning quarter is compared to the State Average Quarterly Wages (SAQW). Those who earned less than one-third of the SAQW will get the 70%; and those who earned one-third or more of the SAQW will get the 60%. One-third of the SAQW is $5,229.98. So, here’s how it breaks down:

- If your highest quarterly earnings are less than $929, your weekly benefit amount (WBA) is $50.

- If your highest quarterly earnings are between $929 and $5,229.98, your WBA is approximately 70 percent of your earnings.

- If your highest quarterly earnings are more than $5,229.98, your weekly benefit amount is EITHER approximately 60 percent of your earnings OR 23.3% of the state average weekly wage ($281.21), whichever is greater.

Now, for some examples…

Example 1

Shelly goes out on disability on April 1, 2018, giving her a base period of January 2017 to December 2017. She had the following gross wages in each quarter:

- January – March: $11,000

- April – June: $10,000

- July – September: $10,000

- October – December: $9,000

Shelly’s highest earning quarter ($11,000) is greater than one-third of the SAQW ($5,229.98), so she is eligible for benefits at 60%. Then, her weekly benefit amount is calculated as follows:

- Find the weekly wages earned by dividing the highest earning quarter by 13 (13 weeks in a quarter): $11,000 / 13= $846.15

- Determine benefit rate at 60%: $846.15 x .6 = $507.70

- Compare the calculated benefit (found in step 2) to 23.3% of the state weekly average of $281.21. Since her benefit amount is greater than the SWA, she is eligible for the greater amount; therefore, her benefit amount is $507.70.

Example 2

Beth goes out on leave on March 1, 2018, giving her a base period of October 2016 to September 2017. She had the following gross wages in each quarter:

- October – December: $4,500

- January – March: $3,000

- April – June: $5,000

- July – September: $3,400

Beth’s highest earning quarter ($5,000) is less than one-third of the SAQW ($5,229.98), so she is eligible for benefits at 70%. Then, her weekly benefit amount is calculated as follows:

- Find the weekly wages earned by dividing the highest earning quarter by 13 (13 weeks in a quarter): $5,000 / 13= $384.62

- Determine benefit rate at 70%: $384.62 x .7 = $269.23

Example 3

Joe just had a baby and goes out on PFL leave on November 1, 2018, giving him a base period of July 2017 to June 2018. He had the following gross wages in each quarter:

- July – September: $5,090

- October – December: $6,000

- January – March: $5,500

- April – June: $6,050

Joe’s highest earning quarter ($6,050) is greater than one-third of the SAQW ($5,229.98), so he is eligible for benefits at 60%. Then, his weekly benefit amount is calculated as follows:

- Find the weekly wages earned by dividing the highest earning quarter by 13 (13 weeks in a quarter): $6,050 / 13= $465.38

- Determine benefit rate at 60%: $465.38 x .6 = $279.23

- Compare the calculated benefit (found in step 2) to 23.3% of the state weekly average of $281.21. Since his benefit amount ($279.23) is less than the SWA, he is eligible to receive the greater amount; therefore, his benefit amount is $281.21.

Also, of note, for claims beginning on or after January 1, 2018, weekly benefits range from $50 to a maximum of $1,216. To qualify for the maximum weekly benefit amount ($1,216) you must earn at least $26,325.01 in a calendar quarter during your base period.

There you have it! Easy as 1-2-3…hmmm, maybe not? But for real, the next time your kid (or your kid in the future) says “math sucks; we’ll never have to use it in real life so why do I have to do it?,” here’s an example you can throw at them. #lifelessons

Hello- Can you tell me what I’m eligible for in regards to pay/time off for maternity leave. I work in El Segundo (with only 7 people in my office); however, our corporate office is in TN. So I don’t think I qualify for any FMLA pay due to the number of people working within the 75 mile radius. My HR department is currently telling me that I am allowed 4 months off (and mentioned they are following TN laws) however, this will be unpaid. I can’t afford to take off that long unpaid so am wondering if there are other benefits I can take advantage of that our TN HR department is not aware of. I’m pretty sure I pay into SDI so am hoping there is something there but it’s all so confusing. Any feedback would be greatly appreciated.

LikeLike

Yes, as long as you’ve been paying into SDI, you are eligible to receive SDI for the entire duration that you are “disabled” by pregnancy and childbirth. SDI provides wage replacement at around 60 or 70% of your normal wages. The “standard” duration that a doctor will certify disability for a healthy, uncomplicated pregnancy and birth is 4 weeks before birth AND 6 weeks after for a vaginal delivery or 8 weeks for a csection. So, at minimum, you could receive wage replacement for 10 weeks during your leave. Should you have any complications before or after birth, your doctor can certify an extension past the “standard” duration, and your SDI benefits will be extended accordingly.

Of note, as a CA employee who works with an employer with over 5+ employees at the CA office, you are legally eligible for unpaid job protection under Pregnancy Disability Leave. PDL, which supersedes FMLA, provides up to 17.3 weeks of job protection for leave due to pregnancy, childbirth, and other related conditions. You don’t get all 17.3 weeks of PDL. The actual duration of PDL is for however long your doctor has certified you “disabled” due to pregnancy and childbirth. The same “standard” duration applies with 4 weeks before birth and 6 or 8 weeks after birth. HOWEVER, if your employer is offering you leave as per TN law at a full 4 months, that’s more generous than PDL, so best to go with that option. I’m not versed in TN law, so I can’t speak to the accuracy and specifics to what your employer has offered you.

Hope that helps!

LikeLike

tremendously – thank you! as a follow up questions, who do i speak with about receiving SDI benefits pregnancy ‘disabled’. would this be my doctor, the state and/or our HR department. if the state, do you have a link, and do you know when i should start my conversation with them. My HR department is currently looking into this but i haven’t heard back from them. my due date is 4.29 so just trying to get all my ducks in a row.

lastly, my husband has the same type of situation. works for a company with approx 12 people in their office in LA however their corporate office is in georgia. does he qualify for anything?

LikeLike

SDI is coordinated through the state, or specifically the Employment Development Department (EDD), not your employer. You can apply for SDI on the FIRST day of your leave through the online EDD portal (http://www.edd.ca.gov/Disability/SDI_Online.htm). You can’t apply for SDI beforehand, so if your last day at work is 3/15, you can’t apply until 3/16. As part of your SDI application, your doctor must also submit a Physician’s Certificate certifying your disability, the start date of your disability and probable duration – so your doctor also plays a role in your SDI process. I would start by getting on the same page with your employer about job protection while on leave. At the same time, I would start to talk to your doctor about when you want to start your leave. The “default” start date that a doctor will certify leave is 36 weeks. Once you know when your doctor will certify your leave, you’ll know when exactly to file for SDI (and when your leave under the law will be effective).

As for your husband, are there 20+ employees within a 75 mi radius of your respective regional offices? Or is it only that one office in CA? In order to be eligible for CFRA, you need to work for an employer who employs at least 20+ employees within a 75 mile radius…so if there are other “local offices” near by, he may be eligible for CFRA. If your husband doesn’t meet this requirement, unfortunately, he is not eligible for CFRA or any type of leave law that will legally protect his job. However, he can coordinate something with his employer to protect his job while he takes some time off when baby comes. If his employer provides him protected leave unpaid, he may be eligible to receive Paid Family Leave (partial wage replacement) for up to 6 weeks. Same for you too, since you don’t qualify for CFRA due to the size of your worksite, you can coordinate additional unpaid job protection through your employer and receive Paid Family Leave while on leave.

LikeLike

thanks again! no, unfortunately my husband does not have 20+ employees working within a 20 mile radius. his HR dept has told him he’ll get nothing. unless we hear different, he’ll plan on using up vacation for a couple weeks after the baby is born.

regarding your comment on Paid Family Leave.. “if his employer provides him protected leave unpaid, he may be eligible to receive Paid Family Leave (partial wage replacement) for up to 6 weeks. Same for you too, since you don’t qualify for CFRA due to the size of your worksite, you can coordinate additional unpaid job protection through your employer and receive Paid Family Leave while on leave.” from your comment, it sounds like we’d need to ask our employers for this. if this is the case, I’m not really sure how I would ask as both our employers have said they do not offer any paid maternity/paternity leave. however, for some reason, i thought PFL was through edd as well?

on a side note, this is all very confusing, and at a time when emotions are high. I’d like to thank you for all the information and resources your blog has provided, and the fast response to all my inquiries. if there is anything I can do to help/thank you properly, please let me know. 🙂

LikeLike

Yes, PFL is through the state (EDD) as well, and it pays out at the same rate as your SDI benefit.

You are (both) eligible to receive PFL by having paid into CA SDI taxes. However, PFL in itself does not provide job protection – it’s only wage replacement – so you would need CFRA to protect your job while on leave collecting PFL. So, when I mention needing to ask your employer, what I mean is that you would need to get approval and/or coordinate job protection with your employer if want to take leave to collect PFL since you don’t have CFRA to protect your job during that time. Hope I explained that well 🙂 this bit always trips people up!

Glad I can be of help! Please let me know if there’s anything you need clarified or have additional questions. Feel free to email me directly at kiks16@gmail.com in case it’s easier to correspond via email!

LikeLike

Hi great website! I gave birth almost 6 months ago via c-section and was wondering if I qualify for Disability Insurance and Paid Family Leave. A little background history – I had moved to California in 2014 and was employed full time (so I had paid into Disability from my paychecks), but as of 2016 I became self employed, which I had not purchased elective coverage. Do I still qualify for Disability and PFL? Also, if yes, is it too late to claim for both since it’s been 6 months since I gave birth? Lastly, if it’s not too late to claim, what should my claim dates be? (since I am self employed, I pick and choose which projects and when I want to work, so my salary is not consistent, and I’ve worked on a couple of small projects between giving birth and now).

I’ve tried reading the EDD websites and Im so confused! Any help will be appreciated!! Thanks in advance!!

LikeLike

Hi there,

Thanks – glad to hear the blog is helpful.

You won’t be able to claim SDI for your childbirth since you’re over the threshold of when you can apply. You need to apply for SDI within 49 days of the first day of your disability.

As for PFL, depending on when you last paid into CA SDI taxes and when you plan to start your PFL, you *might* be eligible. What was the last day you paid into CA SDI taxes?

That said, technically, you aren’t eligible for SDI or PFL when you are self employed. However, you can still try to apply and see if they approve your claim based on previous earnings that were subject to CA SDI taxes.

LikeLike

Thanks for your reply! I read about the 49 days, do you know if it’s a strict rule or would there be a way around it if I claimed ignorance? 😦

How does my PFL start date affect my eligibility? Or better question is, when should I start it to make sure I’m eligible? 🙂

The last time I was employed and got a W2 was March 2016, so from Feb 2014 up until Mar 2016 I had paid into it through withholdings from my paychecks. Even though I’m self employed, when I pay my annual income taxes, I paid for social security taxes, so am I still not eligible for SDI and/or PFL? I guess I’m not quite sure if the social security taxes I paid into when I’m self employed covers SDI or not…or how that’s different from elective coverage.

Either way, I guess I should maybe just apply and see if it’ll get approved! All this tax and benefits stuff is all so confusing! Thanks again for your help!! 🙂

LikeLike

The EDD is pretty strict about the 49 day rule, actually.

Further, given the dates of when you last paid into CA SDI, there would be no way for your base period to include wages earned from Feb 2014 – March 2016. The base period varies depending on the date your disability (SDI) or bonding (PFL) begins. For instance, even if you applied for SDI or PFL today (3/20/2018), the base period in which your eligibility is based on would be from October 2016 through September 2017. The EDD will look at that base period and will find the wages that were subject to CA SDI taxes (and from there will select the highest earning quarter to calculate the SDI/PFL benefit amount). Since you stopped paying into CA SDI as of March 2016, your base period won’t include any wages subject to CA SDI. The post includes an image of the different base periods.

Social security taxes are different from SDI taxes. That said, tax matters is not my wheelhouse, so best to seek advice from an accountant or tax specialist on the specifics.

LikeLike

Aw man, that’s too bad. Thanks for your help anyways!!

LikeLike

Hi so I am employed with 2 different companies that I pay federal wages for. As far as deductions for disability one says ‘California State Disability’ and the other company says ‘California Disability Employee’ on my pay stub under deductions. Does that mean that both companies are deducting for SDI and that I’ll be eligible to use the income towards applying for SDI when I go on leave?

Also I am terminating my employment with one of the companies a few months before I go into leave. Will I still be able to use the wages during my time there to count towards SDI and the amount I’ll be getting when I’m on leave.

Lastly I also do some contract work where I get payed fully then file for taxes. Will I be able to use those wages towards SDI?

LikeLike

Yes, those line items would indicate that you are contributing to SDI through payroll deductions for both jobs.

However, SDI benefits are not calculated off of current wages. Instead, the benefit amount is based off of wages earned during your “based period,” which is 5 to 18 months prior to your disability claim start date. The “base periods” is a set period based on when you start your disability claim. To see your base period, refer to the chart here: http://www.edd.ca.gov/Disability/Calculating_DI_Benefit_Payment_Amounts.htm

As such, if you quit one job prior to leave, you may still be able to claim SDI for both jobs, so long as wages from both jobs were included in the base period.

You likely aren’t contributing to SDI taxes on your contract wages. So, those wages won’t be included in your base period and/or your SDI benefit.

Hope that helps!

LikeLike

I’m currently on leave and trying to figure out when to tell my employer that I won’t be coming back to work. My son is about 5 months old; I took my leave intermittently. I already utilized my 8 weeks of maternity leave and 4 weeks of paid family leave. I’m going back to work for two weeks and I still have two weeks remaining of paid family leave through the state. I’ve decided not to go back to work after I work my two weeks. My question: when do I tell work? Do I tell them next week with the risk that they will mark my last day as July 13th, making it not possible for me to claim my last two weeks of paid family leave if I’m no longer employed? Or, do I wait until July 27th to give them my two weeks notice (over phone) while I’m out on leave indicating that I won’t be coming back. Thank you!

LikeLike

First off, you can still claim PFL even if you quit your job. In order to be eligible for PFL, you must either be employed OR looking for a job. So, if you quit while on PFL, you’ll still be able claim your remaining weeks of PFL, but you might need to provide proof of job hunting (something as simple as sending out resumes) should the EDD follow up with you.

Secondly, what leave are you coming back from? CFRA?

If so, per CFRA regulations, your employer may request that you pay back the healthcare premiums that they paid on your behalf while you were out on leave. CFRA regs stipulate that coming back for 30 working days is considered “returning from leave.” As such, if you work 30 actual working days (i.e. not 30 calendar days), you’d be off the hook to repay the premiums. Also, keep in mind that the law only gives the employer the OPTION, should they chose, to recoup payment. So, it’s not a guarantee that your employer will actually request this.

Hope that helps!

LikeLike

I am having a hard time reconciling the base period, 12 months, with the 5-18 months wage period. I work for the county (in CA) so we don’t pay into CASDI. I’ve been at a county job 10 months before going on PDL, but I paid CASDI with my last job, which ended July 2017 (14 months prior to going on PDL, well within the 18 months requirement).

I am wondering why mention “the base period includes gross wages subject to SDI tax which were paid approximately 5 to 18 months before your disability claim began” and then say the “for a SDI claim to be valid, you must have at least $300 in wages in the base period.” Is it 12 or 18 months?

I’ve tried to call EDD multiple times and can never reach a human to make sense of this issue. Any clarification would be most appreciated.

LikeLike

The base period is approx 5-18 months prior to the start of your disability. However, you need to have earned at least $300 during your base period.

For example: Say someone starts there leave in December 2018, that means their base period is July 2017 – June 2018 (this would be the base period for anyone filing their SDI claim in the months of Oct-December). But, they’ve only started paying into CA SDI taxes at the end of June 2018, and only earned $200 for their entire base period. They would not be eligible for SDI.

Hope that answers your question!

LikeLike

Thank you for a fantastic blog!

I currently am an employee at a company full time. I also work on my own business on the side and receive self-employment income. I pay into SDI via my employer, but not so for my self-employment income (I did not elect to pay into the system).

I know that when I claim SDI and PFL, it will be based on the amounts paid into SDI from my employer from previous periods (5-18 months as stated above). The state is not compensating me for any self-employment income since I did not pay into the system for that income.

Once I go on disability, am I allowed to continue to earn my self-employment income? If so, will it reduce my SDI benefits? Also, where do I report it? I have the ability to stop earning self-employment income during disability, so if this necessary to preserve my disability claim, please let me know.

What about when on I am on PFL? I see here (https://www.edd.ca.gov/disability/Reporting_Your_Wages_PFL.htm) that I am supposed to report self-employment income. How would that affect my PFL claim? I would probably need to start my business back up around the time of PFL, but would rather not forgo it if I do not need to.

I understand I cannot rely on the information you give me, but any guidance or pointing me in the right direction (or someone I can speak with about this (even if they charge)) will really help.

Thank you in advance.

LikeLike

Hi there,

Thanks for reading!

You won’t be able to work at all while you’re receiving SDI since your doctor is technically certifying you as “disabled” and unable to work during the period you are receiving SDI. The only way you could work while receiving SDI is if your doctor put you on a “reduced” schedule thereby allowing you to work part time on your independent business – but, it would be up to your doctor whether to medically release you even on a reduced schedule basis.

As for PFL, you can work while also receiving PFL since you’re no longer disabled at that time. You will need to report your SE income, but whether that reduces your PFL benefit amount will depend on how much SE wages you’re bringing in. Generally, if your SE wages plus PFL benefit are greater than your wages prior to starting disability leave, your PFL will be adjusted accordingly.

Hope that helps.

If you have additional questions, please email me directly at maternityleave411@gmail.com.

Akiko

LikeLike

Hi, I am applying for SDI as my doctor has me on early maternity leave. When I filled out the claim, it asks me about my current/last employer. I put in that information, but no where does it ask me for previous employers of the last 5-12 month period. One year ago, I was working for a company in which I was making 4 times what I’ve made with my current/last employer and I want to make sure my benefit payout reflects that. How do I make sure that happens? I can’t get a hold of any human over the phone on the SDI line so I am worried I won’t be able to get answers and make any necessary changes to my claim.

Any information would be helpful!

LikeLike

The EDD will have your entire employment and salary history by your SSN. So, not to worry – you’ll be fine. Your SDI benefit amount will be calculated properly using wages from the appropriate base period (i.e from your previous employer).

LikeLike

Thank you so much for giving me some peace in the process! This can all be a little stressful!

LikeLike