[UPDATE: The President signed the Family First Coronavirus Response Act into Law on March 18, 2020]

First and foremost, my thoughts go out to anyone who has been affected by the coronavirus. Please remain vigilant, safe and healthy!

As if we haven’t been on high-alert over the coronavirus, many are now experiencing a new reason to keep us up at night: Anxiety over job and income security. According to a recent study more than half of American jobs are at risk because of coronavirus. That’s crazy and incredibly upsetting.

Luckily, the Senate has passed H.R. 6201 — also known as the Family First Coronavirus Response Act (the “Family First Act”) — in an effort to provide emergency relief and support during the 2019 Novel Coronavirus pandemic. The bill now awaits President Trump’s signature, which he is expected to do. Once he signs on the dotted line, it will become effective in 15 days [April 1, 2020].

There are multiple sections of the “Family First Act,” but there are two key provisions that pertain to employee leave rights and wage replacement: 1) The Emergency Family and Medical Leave Expansion Act; and The Emergency Paid Sick Leave Act.

To save you time reading through the whole bill, I’ve distilled the key information in an (hopefully) easy-to-read FAQ.

Emergency Family and Medical Leave Expansion Act

What is it?

The Emergency Family and Medical Leave (FMLA) Expansion Act expands the federal Family and Medical Leave Act (FMLA) to provide a new type of covered public health emergency leave.

Under the Emergency FMLA Expansion Act, eligible employees are entitled to 12 workweeks of job-protected leave when they are unable to work (or telework) due to a need for leave to care for their child under 18 years if the school or place of care has been closed, or the child care provider is unavailable due to a public health emergency. Of note, the Act defines a “public health emergency” as an emergency with respect to coronavirus declared by Federal, State, or local authority only.

It’s important to note that as of today, this is now the only qualifying reason under the Emergency FMLA Expansion Act. This is a significant change from the previous version of the bill passed by the House just a few days ago, which included other coronavirus-related reasons. Those reasons originally included were (I don’t mean to rub salt on wounds, but I figured it best to keep everyone informed of these changes). :

- To comply with a recommendation or order by a public official or health care provider that the employee remain out of work because of (i) exposure of the employee to Coronavirus, or (ii) the employee exhibits symptoms of Coronavirus (where the employee is otherwise unable to comply with the recommendation/order and perform the functions of their role);

- To care for a family member whose presence in the community, as determined by a public health official or a health care provider, would jeopardize the community’s health; and

Is the 12 weeks of leave provided under the Emergency FMLA Expansion Act in addition to what I’m entitled to under “traditional” FMLA?

No, as the name describes, this Act only expands the “traditional” FMLA in respect to leave taken as a result of having to care for a child whose school has closed due to COVID-19. As a reminder, the total amount of leave available under FMLA is 12 workweeks. The Emergency FMLA Expansion Act does NOT change this. Leave taken under the Emergency FMLA Expansion Act counts toward an employee’s 12-week FMLA entitlement, and vice versa.

For example, say your child’s school has shut down due to coronavirus and you need to take leave to care for your child. However, you previously took 4 weeks of FMLA leave for your serious health condition. In this scenario, you would only have 8 weeks of FMLA available to you for taking leave to care for your child whose school has shut down. It’s not perfect, but it’s something.

Is the leave paid?

The first 10 days of this leave (rather than 14 days, as originally drafted) may be unpaid but an employee can elect to substitute accrued paid time off (i.e. sick, vacation, PTO) during this time, including using paid sick time pursuant to the Emergency Paid Sick Act (see below for more info). It’s important to note that under the Emergency FMLA Expansion Act, unlike “traditional” FMLA, an employer cannot require the use of available paid time off if the employee elects not to use it during the first 10 days of leave.

After the first 10 days, employers generally must provide paid leave in the amount of two-thirds of the employee’s regular rate of pay for the number of hours he/she would have otherwise worked. The reason why I say “generally” is because the Act limits the pay to $200/day and $10,000 in the aggregate per employee.

For employees who work a part-time or irregular schedule, the daily rate of pay is calculated by taking an average of the number of hours the employee worked per day over a 6-month period prior to taking Emergency FMLA.

Will this apply to my employer?

The Emergency FMLA Expansion Act applies to all employers with fewer than 500 employees.

Note, this means that employers with 1 to 499 employees will be considered “covered” employers under this Act. This is a significant expansion from “traditional” FMLA, which is limited to private employers with 50 or more employees.

But there may be some limitations. Per the language in the Act, the Secretary of Labor would have the authority to exclude certain health care providers and emergency responders from coverage, as well as certain employers with fewer than 50 employees if imposing such requirements would jeopardize the viability of the employer’s business.

Also, this applies to all public agencies, regardless of size.

Which employees are eligible?

The Emergency FMLA Expansion Act applies to any employee who works for a “covered” employer (as defined above) and has been employed for at least 30 calendar days. This too is a significant expansion from the “traditional” FMLA eligibility criteria, which requires that employees be employed for at least 12 months and have worked at least 1,250 hours.

Will my job be protected if I take leave covered under the Emergency FMLA Expansion Act ?

Employees working for employers with 25 or more employees are entitled to the same job-protection rights as “traditional” FMLA. Generally, FMLA requires employers to restore covered employees to the job they had before they took leave.

Unfortunately, employers with fewer than 25 employees are not required to comply with FMLA’s job restoration if the employee’s position when they begin leave does not exist due to economic conditions or other changes in the employer’s operating conditions that (1) affect employment and (2) are caused by a public health emergency during the leave period. If reinstatement is not required, an employer would be required to make reasonable efforts to contact the employee if an equivalent position becomes available for up to a year following the employee’s leave.

EMERGENCY PAID SICK LEAVE ACT

In addition to the Emergency Family and Medical Leave Expansion Act, the other major provision coming out of the Family First Act is the Emergency Paid Sick Leave Act.

What is it?

The Emergency Paid Sick Leave Act, which operates in tandem with the Emergency FMLA Expansion Act, requires private employers with fewer than 500 employees to provide up to 2 weeks of paid sick leave to all employees for certain covered purposes related to the Coronavirus outbreak.

The covered purposes related to the Coronavirus outbreak include:

- The employee is subject to a Federal, State, or local quarantine or isolation order related to COVID-19.

- The employee has been advised by a health care provider to self-quarantine due to concerns related to COVID-19.

- The employee is experiencing symptoms of COVID-19 and seeking a medical diagnosis.

- The employee is caring for an individual who is subject to an order as described in subparagraph (1) or has been advised as described in paragraph (2).

- The employee is caring for a son or daughter of such employee if the school or place of care of the son or daughter has been closed, or the child care provider of such son or daughter is unavailable, due to COVID-19 precautions.

- The employee is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor.

Will I be paid?

Yes.

The Emergency Paid Sick Leave Act provides full-time employees with up to 80 hours of paid leave. Part-time employees are entitled to the number of hours equal to hours they’ve worked, on average, over a 2-week period.

If employees use emergency paid sick leave for reasons 1-3 (see above), then employers must pay the employee their full salary during the period of leave, based on their regular rate of pay, up to a limit of $511 per day and $5,110 in the aggregate.

If employees use emergency paid sick leave for reasons 4-6 (see above), then employers must provide pay at two-thirds of the employee’s regular rate of pay, up to a limit of $200 per day and $2,000 in the aggregate.

Will this apply to my employer?

The Emergency Paid Sick Leave Act applies to all private employers with fewer than 500 employees. In addition, all public employers are covered by the Act, regardless of size.

Which employees are eligible?

The Emergency Paid Sick Leave Act applies to all employees regardless of how long the employee has been employed by the employer. However, the employee must work for a “covered employer,” as defined above.

Any other important things to note about the Emergency Paid Sick Leave Act?

The Emergency Paid Sick Leave Act is in addition to any paid sick leave already offered by an employer. Also, an employer may not require that an employee going out on leave search for or find a replacement employee to cover their hours/shift. Further, an employer may not require an employee to use other paid leave before using paid sick time under the Emergency Paid Sick Leave Act.

OTHER QUESTIONS

Will the Emergency FMLA Expansion Act and/or the Emergency Paid Sick Leave Act apply if I’m unable to work due to my employer closing down business?

Unfortunately, most likely, no.

To be eligible for either the Emergency FMLA Expansion Act and/or the Emergency Paid Sick Leave Act, the need for leave must fall into one of the covered leave reason(s) for each respective Act.

For example, say you’re a server at a restaurant, and your employer temporarily shuts down business operations due to coronavirus concerns. Since your reason for being unable to work does not fall within the covered reasons for Emergency FMLA Expansion Act and/or the Emergency Paid Sick Leave Act, you would not be eligible for benefits under these Acts. However, you may be eligible for wage replacement under statutory state programs, such as unemployment insurance. If you’re in California, check out these helpful FAQs from the EDD (here and here).

When will these laws become effective?

The bill now awaits President Trump’s signature, which he is expected to do. Once he does, both of these laws will become effective in 15 days (April 1, 2020). Also, these are temporary laws, expected to sunset on December 31, 2020. [UPDATE: The President signed the Family First Coronavirus Response Act into Law on March 18, 2020]

Will these Acts apply to Federal employees?

Most employees of the federal government are covered by Title II of FMLA, which was not amended by this Act; and therefore, NOT covered under the Emergency FMLA Expansion Act. However, federal employees covered by Title II of FMLA are covered under the Emergency Paid Sick Leave Act.

Lastly, there may be additional changes between now and when it gets to the President’s desk. I’ll update this post with any new developments.

###

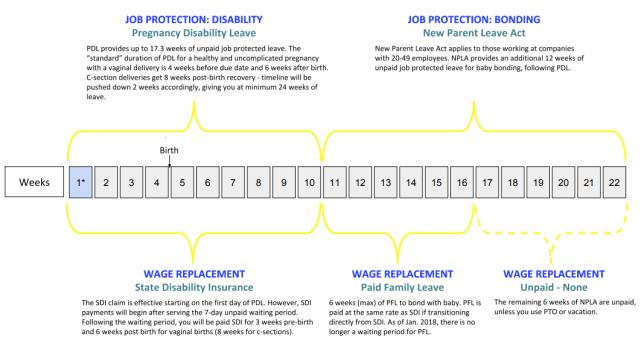

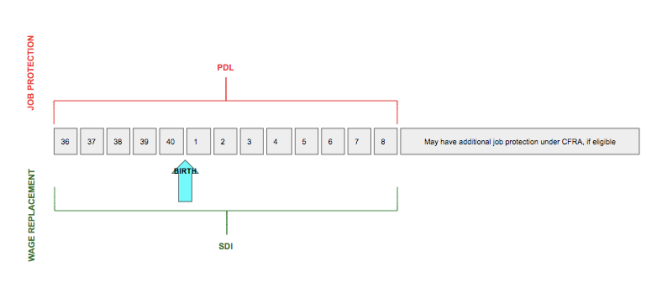

Example 2: If you’re overdue by 2 weeks (gasp!), same sitch. Your pre-birth PDL/SDI time will simply be extended until week 41, you’ll give birth at 42 weeks, and you’ll continue with PDL/SDI for however long necessary for post-birth recovery (either 6 weeks for vaginal, 8 weeks for c-section, or longer if medically necessary).

Example 2: If you’re overdue by 2 weeks (gasp!), same sitch. Your pre-birth PDL/SDI time will simply be extended until week 41, you’ll give birth at 42 weeks, and you’ll continue with PDL/SDI for however long necessary for post-birth recovery (either 6 weeks for vaginal, 8 weeks for c-section, or longer if medically necessary).