UPDATE 2021: This post has been updated to reflect the expansion of the California Family Rights Act (CFRA). Effective January 1, 2021, SB 1383 expanded CFRA to apply to private employers with five or more employees (regardless of the number of employees within a 75-mile radius). To be eligible for CFRA, an employee must also 1) have completed at least 12 months of employment with the company, and 2) have worked at least 1,250 hours of service within the past year. Furthermore, SB 1383 repealed California’s New Parent Leave Act (NPLA) effective December 31, 2020.

UPDATE 2020: This post has been updated to reflect the increased benefit period of Paid Family Leave (PFL).

UPDATE 2018: This post has been edited to reflect the addition of the New Parent Leave Act (NPLA), as well as increased benefit amounts for SDI and PFL. Read this to get the full scoop!

There are seven wonders of the world. Wrong! There are eight; the final one being the mysterious maternity leave. When I found out I was pregnant one of the things that made me jump for joy (next to loving the alien bump growing inside me, obvi) was the prospect of setting off into maternity leave bliss. I felt like I had paid my dues working in stressful PR jobs throughout my career, so I knew I wasn’t going to be shy about really maximizing my maternity leave benefits.

But this was all much easier said than done since figuring out how to milk the system was incredibly hard to find. Pinpointing concrete information on maternity leave was like setting out on a mission to discover El Dorado. No joke guys, I was seriously OBSESSED with figuring out all the details of maternity leave. Also, I was convinced that my employer was short-changing me several weeks of precious leave, so off to scouring the internet I went.

First, as a disclaimer, I am not an attorney, and I do not provide legal advice. I now hold a credential as a Certified Leave Management Specialist, and received the SHRM California Law HR Specialty Credential.

IMPORTANT: The following applies to employees who are eligible for Pregnancy Disability Leave (PDL) AND California Family Rights Act (CFRA). Eligibility requirements for PDL and CFRA are discussed in the post.

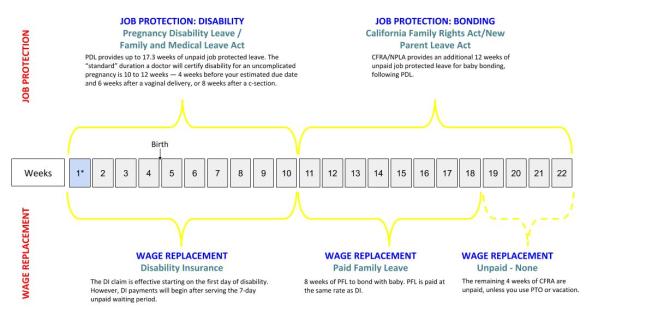

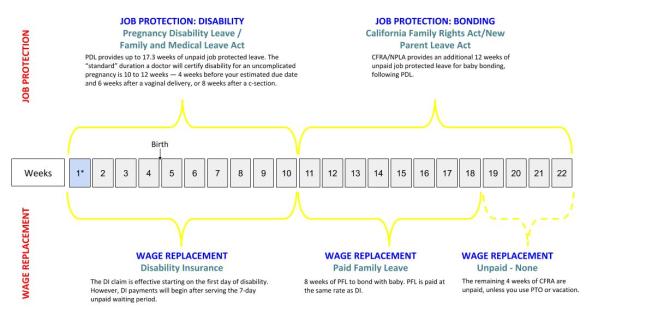

Let’s get right to it. The bottom line is that for any healthy preggers (i.e. no need for extended bed rest during pregnancy or reasons to be out of work due to complications after birth), at minimum, you can get 22 or 24 weeks of maternity leave (22 weeks for vaginal delivery and 24 weeks for c-section). Now, not all of that time is paid (I’ll get to that later), but what this means is that you get 22 or 24 weeks of job protection.

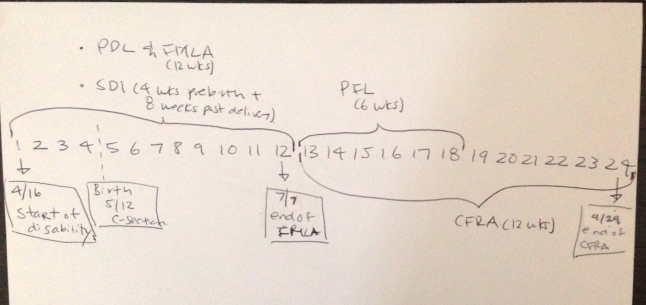

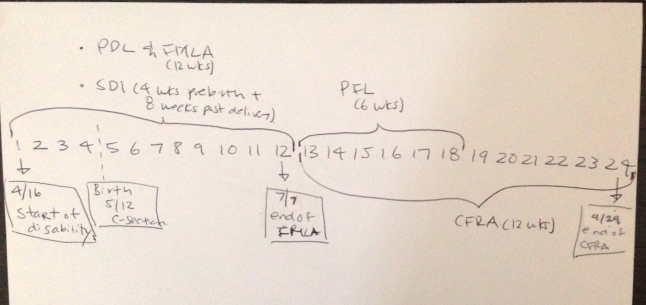

There are many ways to explain maternity leave, but I think it’s easiest to explain it in chronological order. Here’s a chart I drew up (don’t mind the chicken scratch writing) and I’ll explain each step. I should mention that this chart is based on me having had a c-section on May 12.

My 24 week maternity leave timeline. I started my maternity leave on April 16, approximately 4 weeks before my due date. I gave birth via c-section on May 12, which ended my PDL on July 7 (8 weeks after 5/12). At the end of PDL, my 12 weeks of CFRA kicked in, giving me a go-back-to-work date of September 29.

For a timeline for a typical, uncomplicated pregnancy and vaginal birth, check out this baby (pun intended).

1) Starting your disability

First, decide when you want to start your maternity leave. Some take a week or two off before baby is expected to arrive, while others work literally right until the moment they are saddled up in the stirrups. (I once had a boss who actually sent me an email while in labor.) Whatever you decide, know that you can start your maternity leave 4 weeks before your estimated due date! Whaaat? No way!? Yep, this is true!

Pregnancy Disability Leave (PDL) starts the first day of your maternity leave, and provides up to 17.3 weeks of job protected leave for the purpose of pregnancy, childbirth, and other related conditions. Before y’all get excited over the 17.3 weeks, note that you don’t automatically get all 17.3 weeks of leave. The actual duration of your PDL must be certified by your doctor, but the “default” duration of PDL for a healthy, uncomplicated pregnancy/childbirth is 4 weeks before birth and 6 weeks after for a vaginal delivery or 8 weeks after for a c-section (I’ll provide more detail on the post-birth portion later, as well as information on what happens if you have complications).

The only eligibility requirement for PDL is that you work for an employer with 5+ employees. There is no additional eligibility requirement, such as minimum hours worked or length of service.

PRO TIP: The 4 weeks before delivery is a “use it or lose it” situation. You don’t get to tack it on later, so if your individual situation allows for it USE IT. Some of my colleagues balked at me taking 4 weeks off before my due date saying I’ll get bored. Psshhh. Only boring people get bored, but on the real tip, the extra rest is amazeballs and I (assume this is the norm for all preggos) got HUGE in the last 2 weeks. Also, taking off 4 weeks before your due date will NOT affect your “go back to work” date, since that date is calculated from your delivery date – not when you started maternity leave. I had a lot of people tell me that they would rather spend the extra 4 weeks with their newborn rather than take off early for maternity leave — not the case, mah friends!

It’s important to note that the 4 weeks before due date is just the “default” start time that a doctor could certify disability for pregnancy. Should you have any complications during your pregnancy (i.e. high-risk issues, preeclampsia, bed rest, etc), your doctor can write you out earlier than 36 weeks or at any point during your pregnancy your doctor feels medically necessary. Any time taken before birth simply gets deducted from your 17.3 weeks of PDL “bank.”

So, what happens if you have a high-risk pregnancy and your doctor certifies you “disabled” super early, like at 28 weeks? Let’s say you give birth at 40 weeks via c-section, that would mean that upon birth you would only have 5.3 weeks of PDL remaining (17.3 – 12), but you still need 8 weeks of PDL for post birth recovery. In this scenario – where you exhaust all of your PDL but still experiencing a disability – you may be eligible for additional leave under CFRA (if eligible) or through “reasonable accommodation” under ADA/FEHA, which can provide additional time off.

As you patiently wait the arrival of your precious offspring, your job will be protected under the PDL and you will be paid 60% or 70% of your weekly wages through State Disability Insurance (SDI). [Check out this post for the 411 on how to calculate your SDI benefit amount.]

Wage replacement through SDI begins on the first day of your PDL; however, there’s a mandatory unpaid 7-day (calendar days) waiting period that you must serve before receiving your SDI benefits. You will not be paid during the waiting period, but you can use whatever form of paid leave (sick, PTO, vacation) to pay yourself before SDI kicks in. The first payable day is the 8th day of your claim. And, SDI will continue through the entire duration that you are “disabled” by pregnancy and childbirth.

As a side note, you’ll often see references of PDL and FMLA combined, which can make things super confusing. The reason why they often come as a pair is because they run concurrently – they both start the minute you begin your maternity leave. However, in the context of maternity leave in California – don’t even worry about FMLA. FMLA simply runs in the background of PDL since PDL (state law) supersedes FMLA (federal law). Plus, PDL is much more generous than FMLA, giving you up to 17.3 weeks of leave versus 12 weeks under FMLA. Further, the eligibility requirements for PDL are more lenient than FMLA. The only eligibility criteria for PDL is that you work for an employer with 5+ employees. With FMLA, you must work for an employer with over 50+ employees in a 75 mile radius, you must have worked at your employer for at least a year, and you must have clocked in 1,250 hours of service prior to the start of your leave. So, thanks California for looking out for pregnant mommas!

2) You had your baby!

Okay, so after 4 loooong weeks your beautiful baby has finally entered the world. Hooray!

Once your baby is born, your PDL will continue for an additional 6 weeks for a vaginal birth or 8 weeks if you had a c-section; and you’ll continue to get wage replacement through SDI (still at around either 60 or 70% of your normal wages).

Your doctor will determine when you are cleared from disability. While this is typically 6 or 8 weeks after birth, should you have any complications – physical or mental (i.e. postpartum depression) – your doctor can certify an extension to your PDL, and your SDI benefits will be extended along with it.

3) Your baby is now 6 or 8 weeks: Now it’s time to bond

Once you’ve completed your 10 or 12 weeks of PDL (4 weeks before birth + 6/8 weeks after birth) – or more importantly, when your doctor has certified you no longer disabled by your pregnancy or childbirth – the clock gets reset with an additional 12 weeks of unpaid, job-protected leave under the California Family Rights Act (CFRA) to bond with your baby. In order to be eligible for CFRA, you must meet ALL of these requirements:

- Your employer has at least 5 employees.

- Have worked for your employer for at least 12 months.

- Have worked at least 1,250 hours of service within the past year.

During CFRA leave, you will be paid partial wage replacement through Paid Family Leave (PFL) at the same rate as your SDI, but here’s the kicker…only for 8 weeks. This means that while you have 12-weeks of job protection under CFRA, you’ll get partial pay for only 8 of those weeks. Bummer. The remaining 4 weeks are unpaid, but you can apply any unused vacation or PTO time to offset being unpaid for the remainder of your leave. Also, you don’t need to take your 8 weeks of PFL all at once. You can break it up and take it in hourly or daily increments if you want. However, do note that CFRA stipulates that your employer may require that the minimum duration of leave is 2 weeks, or unless otherwise approved by your employer.

4) Your maternity leave has ended and you’re back at work

Okay, what I’m about to say next is important! Your “return to work” (RTW) date is determined by when your CFRA ends.

Example 1: Anna starts her maternity leave at 36 weeks, has her baby vaginally on June 12, and has no complication after birth. Here’s what her timeline and return to work date would look like:

[NOTE: The charts below have not been updated with the increased 8-week benefit duration of PFL. Sorry! But you get the idea, yeah?]

Example 2: Oh no, Anna ended up getting an emergency c-section!

I won’t sugar coat it; it’s not easy going back to work after being out for 22-24 weeks. But, you make do and just like all things that suck at the beginning, once you get into the swing of things, you will find joy balancing out work and family life.

Hope this all makes sense. If you have any questions or issues, leave a comment!

P.S. BTW, turned out that my employer WAS wrong about when I was supposed to go back to work. Muahahaha! Knowledge is power, friends; knowledge is power!

If you have questions regarding California maternity leave, or would like more information on how I can provide individualized support to help maximize your maternity leave, please visit Maternity Leave 411.

If you’re NOT eligible for FMLA/CFRA, read this!